Ready to Build a Property Portfolio That Works for You—Not Everyone Else?

Strategically bespoke property portfolios, for high earning professionals who are serious about getting it right the first time.

THE CRUCIAL QUESTIONS YOU HAVEN'T BEEN ASKED

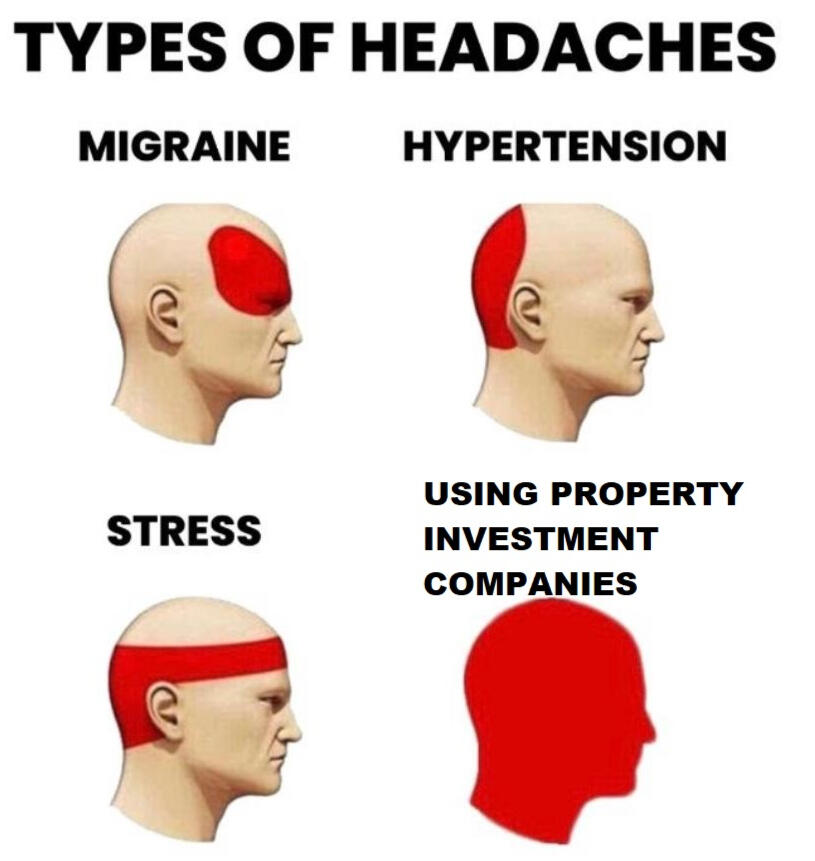

Most investors today are smart. They have done research, learned the basics, and know how to steer clear of the obvious mistakes.The real pitfalls are the ones no one talks about, because unless you’ve worked behind the scenes, you wouldn’t even know they’re there. Fact is no one is building diverse, secure portfolios, as they're not incentivised to do so.There are many vital questions that need to be asked—here are just three of them to get you thinking?

1. When the agency asked what your plan is if you can't get a mortgage on completion, what did you say?

They probably didn't ask this but it’s one thing to secure a deal. It’s another to make sure you can complete. Companies selling off-plan properties often skip this part, knowing full well their job ends once you’ve signed on the dotted line.

2. Do you know why a particular strategy or location ties in with your goals, experience and personal situation?

Ever get the feeling that every agent is pushing the same location or strategy? That’s because they are. Why? Because certain places are easier for them to sell, or because that’s where their commissions are highest. But do these areas or strategies match what you’re actually trying to achieve? Or are you just being sold what’s easiest for them?

3. What happens if your chosen property strategy collapses under market changes, what would you do?Markets shift, strategies fail. But when you know what to do, you don’t just survive—you thrive. People talk about the 18-year property cycle but not why it matters

It's what you don't know

It’s not just about guiding through the front end of a property investment. It’s about protecting you from getting caught up in strategies that benefit someone else, not you. We've been on the other side of this business, and seen how it works.You don't know, what you don't know.

Start the conversation

Lucas James Property isn’t for everyone, and we’re upfront about that. For those we are aligned with, well that will become clear on that first call.Just pop your details below and we will be in touch to find out if there is reason for us to dive deeper.

Speak soon